“Don’t tell me you own tractor” The story goes like this: An Oklahoma couple are in a bind with four vehicles that cost $2,500 per month and now he’s without a job. Dave Ramsey gave him 3 options

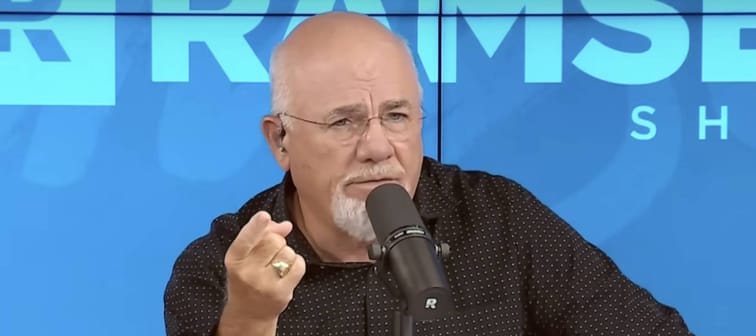

The couple’s installments for these debts are so expensive, Ramsey said it made him “want to puke” on an show on “The Ramsey Show.” Ramsey declared, “Don’t tell me you have tractor. I’ll slay you.”

Although David hasn’t provided specifics about the degree of upside the loan are is clear that selling the vehicle won’t suffice. The owners of the cars may still owe thousands in a lump sum, if they decide to sell their cars privately or give them in the hands of a bank. The repossession of vehicles in voluntary form should be avoided as much as is possible, according to Ramsey.

What’s worse their situation is the drop in the value of used cars. “… has been on the decline since its high in early 2022 prices for used cars have dropped over 20%, as per”the Manheim Used Vehicle Value Index,” Bloomberg published in December.

The expert in finance outlined three options for them to decide to take action.

Place cash in a stack, and pay the gap

One method to handle an asset that is underwater according to Ramsey the best approach is to “stack cash and cover the difference.” The idea is cutting down on costs and increasing your income could aid David along with his spouse build up enough money to cover gaps between car loans and the value of their cars.

The problem is that David was recently fired from his position, making it more difficult to implement this plan as soon as possible. The debt load is enormous. David as well as his spouse have to pay monthly $852 for their vehicle as well as the SUV of her, and $555 and $408 for two bikes. In total, the couple will need approximately $2,500 per month to cover these expenses but they are currently living on a single income and unemployment insurance.

“I know you lost your job but right now is not the time to wait for your dream job to come along,” declared host Jade Warshaw. “Right now get any jobs you can.” Ramsey suggested that he think about taking rides and food deliveries. “You can drive because you’ve got a lot of things to drive,” Ramsey told him with a smile.

You can borrow the difference

David could also take out a loan to cover the difference in the price of the purchase and its market value. Ramsey advised him to take out a loan with the credit union or other lenders. Then, he can use the funds along with the proceeds from selling the vehicles privately to repay the loans on autos in total.

This type of debt consolidation is a standard strategy, in the opinion of TD Bank. Most borrowers draw on the equity in their homes or take out personal loans for the purpose of paying off debts that are either too costly or due soon (though the use of home equity comes with its own risk).

This strategy also depends on the creditworthiness of the borrower as well as income. Therefore, David’s unemployment rate could impact the strategy.

Meet with your loan provider in person

Ramsey’s last suggestion is to talk directly with the auto lender. David’s auto loan may be deposited in a local bank or credit union, where the manager is open to considering another option: an unsecured note for the difference in the amount of the loan and the potential resale value of the vehicle.

It is crucial, Ramsey told David, to do this “in in person and not over the phone, and for God sakes, don’t do it via email! Take a seat and look them in the eyes.” Debt restructuring and refinancing is a challenge however it is definitely possible.

The largest corporations, including auto dealerships, and ironically are often restructuring debt. Carvana, a used-car manufacturer Carvana (CVNA) was able to successfully restructuring $1.3 billion of debt in the last year to stay out of bankruptcy. Individual borrowers are advised to think about such discussions as well.

Another option: yard sales

Based on the idea that the family with four vehicles has greater assets Warshaw advised David to sell other belongings in order to get cash. “Something tells me with these trucks and vehicles, you’ve got more stuff laying around to get rid of,” she added.

Lawnmowers, exercise equipment furniture, or any other item that is worth scrap could be offered for sale to families get out of the plight of their lives and allow the family some time to breathe.

SPONSORED

This Company Will Help Nearly Anyone Get Rid of Credit Card Debt

Do you feel that you’re paying on your credit cards is a perpetual cycle with no resolution in the distance? Don’t worry, you’re not the only one. Personal loans offer reduced interest and fixed monthly payments which makes it an ideal option to consolidate higher-interest debt on credit cards. It saves money, reduces the cost of payments and speeds up debt repayment.

Fiona is a completely free online service that demonstrates the best loan options to settle the credit card debt you owe quickly and save money on interest.

Leave a Reply